Q. Is this course worth it?

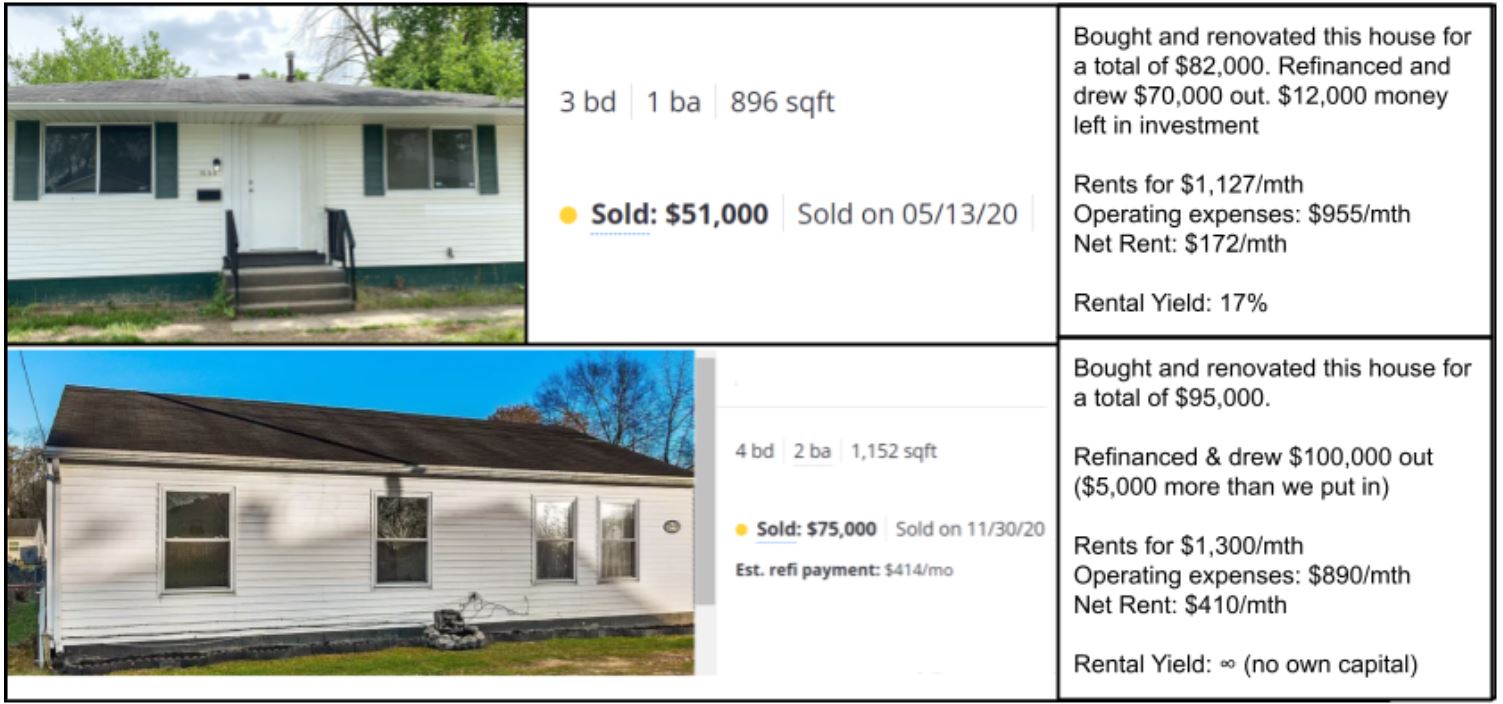

A. For only a few hundred dollars, your investment in this course will pay for itself 100x over.

That’s because this course will get you started on your US real estate journey, like what I did to grow my annual rental income from $0 to over 6 digits in the span of just over 3 years, while in my 30s.

Q. How fast can I start buying US properties after going through your course?

A. With the course content, you will immediately be able to start scouting for and evaluating properties!

Q. How much capital will I need?

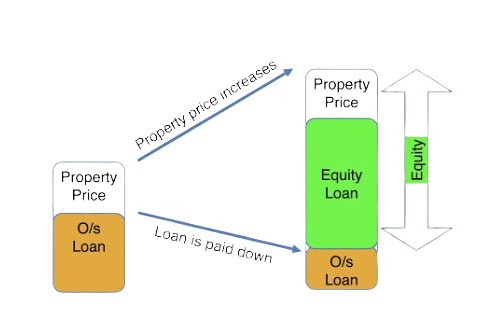

A. Generally, a good starting amount will be about US$70,000 in capital, which could easily get you a ~US$200,000 property. f you don't have this much, we can share strategies of how to create win-win situations, and leverage on your existing resources.

Q. I’m no Bill Gates, Steve Jobs or Elon Musk

A. I started with zero real estate background and zero rental properties. You don’t have to be smart or rich to start. The course is broken down into bite sized lessons that includes hands-on step by step guides. By the end of each lesson, you will have a piece of your investment research already done.

Q. Will the teachings in this course work in any country?

A. Yes, although the course is focused on property investing in the US. The investing principles can be applied to anywhere in the world.

Q. With rising interest rates and the economic turmoil, it seems like Real Estate is going to crash.

A. That would be the most ideal time to buy! You want to be ready and equipped with the necessary knowledge and skills before that happens. Don’t wait till the crash to start learning. Learn now and get everything ready, and act when things are crashing.

Q. What are the dates of the Masterclass?

A. The Masterclass is 100% online, remote, and self-paced! You will be able to schedule a complimentary 1-on-1 consultation call with us once you have finished the syllabus. On top of that, you will be entitled to group coaching sessions for LIVE Q&A with us and other students.

Q: Can foreigners own properties in the US?

A. Yes, there are no foreign restrictions on land or real estate ownerships.

Q: Are there capital outflow restrictions when I take my money back?

A. There are no restrictions on how much you can transfer out of US. Having capital outflow restrictions will affect their status as the world reserve currency,

Q. Is it true that US Taxation is expensive and complicated?

A. While taxes on US salaries are indeed expensive, the IRS provides several tax write-offs for rental income. You can hire a tax accountant to do your tax returns.

Q. Can I buy properties in the US if I own a HDB, within MOP (Minimum Occupation Period)?

A. Yes, there are strategies to help you structure your investments through a company, which is a separate legal entity. Hence you do notneed to worry about your HDB's MOP being impacted.